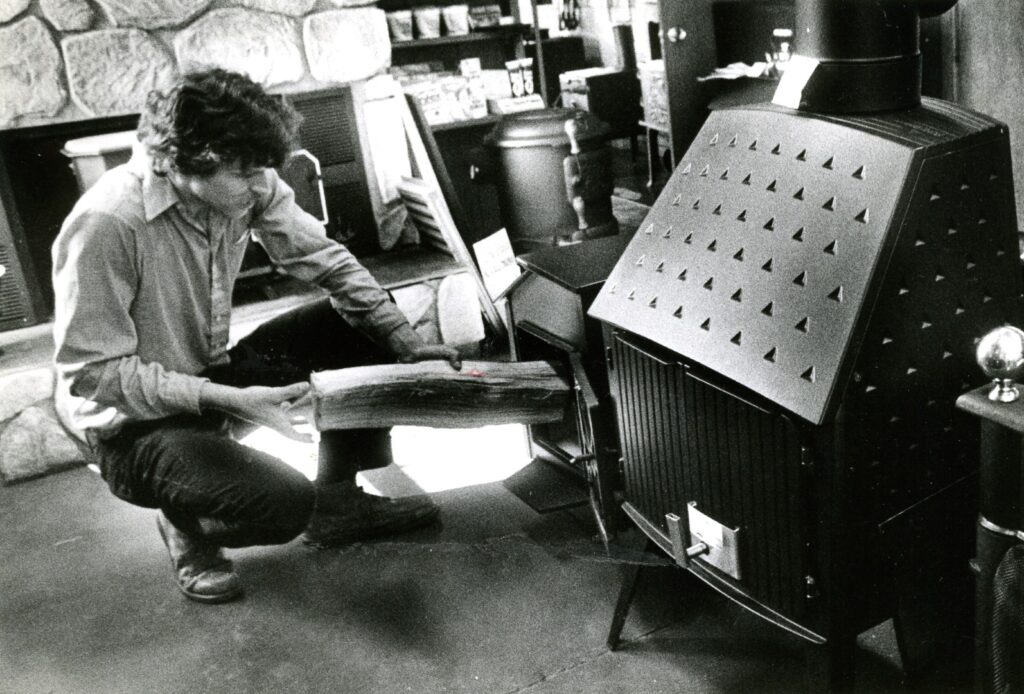

With winter upon us, the quest for a cozy and efficient home heating solution becomes paramount for many homeowners. At The Stove Shop, a trusted provider of quality heating solutions since 1977, we understand the importance of not just staying warm, but also saving money. That’s why we’re excited to share how our wood stoves & wood inserts can not only elevate the comfort of your home but also provide financial benefits through the newly available tax credits.

The Biomass Stove Tax Credit Explained

Beginning in 2023, a significant incentive has been introduced for homeowners seeking to invest in highly efficient heating solutions. Thanks to the advocacy behind the Biomass Thermal Utilization (BTU) Act, consumers purchasing eligible wood or pellet stoves, may claim a 30% tax credit. This credit is applicable to the total cost, including purchase and installation, capped at $2,000 annually, and is available through December 31, 2032.

For further details on this initiative and how it might apply to you, visit the Hearth, Patio & Barbecue Association (HPBA) consumer information page.

Qualifying Products

Vermont Castings has long been synonymous with quality and efficiency in home heating. Their wood stoves not only meet but exceed the 75% efficiency mark required for the tax credit. This makes them an ideal choice for anyone looking to upgrade their home heating system while benefiting from the tax credit. To explore which Vermont Castings models qualify, check out their efficiency listings.

Installation Matters

It’s important to remember that the credit can be claimed in the year the qualifying product is installed. For example, a stove purchased in 2021 but installed in 2022 qualifies for the credit on your 2022 tax return. This distinction underscores the importance of planning your installation timeline to maximize your eligibility for the credit.

Your Tax Situation

While the tax credit offers a substantial incentive, it’s crucial to consult with a tax professional regarding your specific tax situation. The benefit you receive from the tax credit can vary based on your overall tax liability. For those with lower tax obligations, the impact of the credit may differ.

For comprehensive information on how to claim the credit, refer to the IRS’s draft forms and instructions for Residential Energy Credits.

Why Choose The Stove Shop?

At The Stove Shop, we pride ourselves on our decades-long history of helping customers find the perfect heating solutions for their homes. Our expertise in installing wood stoves since 1977 positions us uniquely to assist you in choosing and installing a wood stove that not only meets your heating needs but also qualifies for the tax credit, ensuring both warmth and savings. Give us a call 610-935-9334, if you would like to find out the cost of installing a wood stove in your home from The Stove Shop.

Investing in a Vermont Castings wood stove is more than just a purchase—it’s a step towards a more efficient, comfortable, and cost-effective home environment. With the added benefit of the new tax credit, there’s never been a better time to explore how a wood stove can transform your home during winter.

For more details on our range of wood, pellet and gas stoves, visit The Stove Shop. Let us help you stay warm and save money this winter and beyond. We offer everything from gas fireplaces to wood stoves and pellet fireplace inserts or linear electric fireplaces. Serving Chester county, Delaware county & Montgomery county.